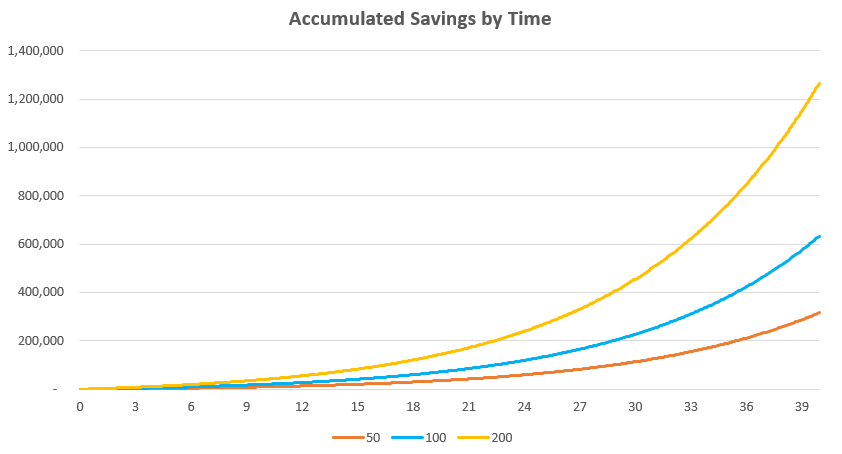

Whenever I meet with my financial planning clients, one of the charts they’re always most surprised by is when I demonstrate the impact of increasing their savings by even the tiniest amounts. If you’re not currently on track to have enough savings to retire comfortably, all hope is not lost. Even a small tweak to your current spending habits could make all the difference in the long run. But don’t just take my word for it – let’s look at the numbers.

How Much Do I Need to Save to Make A Million Dollars?

If you took $50 at the end of each month and invested it, then repeated that month after month, year after year, you would wind up with approximately $316,000 at the end of 40 years. Likewise, $100 per month eventually turns into $630,000. $200 per month grows into $1.265 million! (If you want to work backwards, ending at exactly $1 million would require monthly contributions of $159, or $5.22 per day)

Note: these numbers assume a 10% annual return, which is roughly the average over the past 30 years. If your returns would higher than that you would make your million even faster.

Think about what these numbers mean for a minute. Becoming a millionaire doesn’t require making six-figures or inheriting a giant sum of money from a rich uncle. It requires forgoing that extra cup of coffee each day or going out to dinner one less time per month (Americans spend $300 per month dining out, per BLS data). So the answer to “how much do I need to save to make a million dollars” isn’t a dollar figure as much as a mindset. You need to live within your means and spend less than you make. If you do that, almost anyone can achieve the goal.

If you need some help with budgeting and getting your expenses in line, we can certainly help with that.